Monetary safety comes from having a number of sources of revenue. Nonetheless, it’s additionally necessary to have variety within the sorts of revenue that you’ve.

As an illustration, engaged on a full-time job and two part-time jobs will provide you with a number of sources of revenue. However think about how your life is that if that’s the case; I’m positive you’re at all times exhausted from all of the work you’re doing.

What if as an alternative, you could have a full-time job, an condo rental, and a web based enterprise. You even have a number of sources of revenue, however your days aren’t as hectic as our first case, proper?

That is what I meant about having variety within the sorts of revenue that you’ve.

The Totally different Varieties of Earnings

Earnings may be described underneath differing types. However at present, we’re solely fascinated by 4 sorts.

The most well-liked is the dichotomy between lively and passive revenue.

- ACTIVE INCOME: Earnings that requires work. To earn, it is advisable spend effort and time. It’s you working for cash. Instance: a job wage.

- PASSIVE INCOME: Earnings that requires no or little work. To earn, you merely have to attend. It’s cash working for you. Instance: dividend revenue from an funding.

Much less well-liked, however equally attention-grabbing, is the spectrum of linear and residual revenue.

- LINEAR INCOME: Earnings which you can earn solely as soon as. Work after which obtain a one-time revenue. Instance: earnings from a buy-and-sell transaction.

- RESIDUAL INCOME: Earnings which you can earn a number of occasions. Work after which obtain revenue from it many times. Instance: royalty funds from a e-book you wrote.

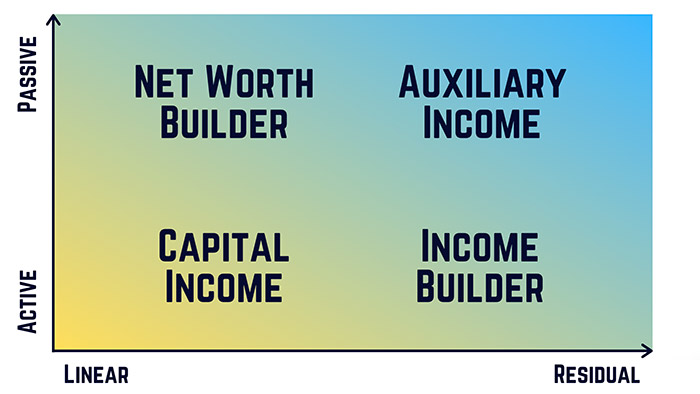

The Earnings Matrix

A number of months in the past, I had this concept of plotting these kind of revenue on a aircraft. The vertical axis could be the ACTIVE and PASSIVE vary, whereas the horizontal axis could be the LINEAR and RESIDUAL array.

After doing so, I described the sorts of revenue that the intersections would produce. And that is what I got here up with:

CAPITAL INCOME

The intersection between ACTIVE and LINEAR revenue. Earnings that’s earned right here often turns into the capital for different ventures. It’s probably the most accessible approach to generate income, that’s why it’s typically the primary supply of revenue for lots of people.

NET WORTH BUILDER

The intersection between PASSIVE and LINEAR revenue. It’s the area for long-term investments that respect in worth through the years. This consequently helps construct and improve your internet value.

INCOME BUILDER

The intersection between ACTIVE and RESIDUAL revenue. The sources of revenue on this space require a whole lot of work however you’ll be rewarded with steady revenue afterward. The semi-passive nature of the money circulation means that you can construct a number of sources of revenue right here.

AUXILIARY INCOME

The intersection between PASSIVE and RESIDUAL revenue. It’s the quadrant for fixed-income devices that constantly present money circulation with little or no effort. Nonetheless, you’ll be able to not often dwell off the revenue right here, that’s why it may solely function a supplementary supply of money circulation.

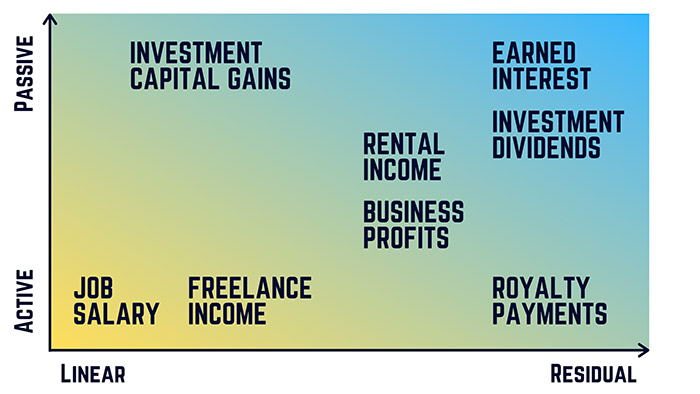

Are you able to think about the place the totally different sources of revenue would place inside this aircraft? Right here’s how I imagined it could seem like:

Diversification in your Sources of Earnings

What have I realized from doing all these?

In the identical means that diversification is nice for our funding portfolio, I spotted that having diversified sources of revenue is nice for our money circulation.

It permits us to leverage our time and optimize our efforts, so we don’t work ourselves to exhaustion in constructing our wealth.

All of it begins with incomes CAPITAL INCOME to cowl our mandatory bills. The excess money can then be funneled in the direction of NET WORTH BUILDERS and sources of AUXILIARY INCOME. Lastly, we study to work smarter and never more durable by creating INCOME BUILDERS.

In different phrases, spend lower than what you’re incomes so you’ll be able to make investments. And use your free time to work on initiatives or pursue ventures that can create semi-passive revenue, so you’ll be able to make investments extra and safe your monetary future.